The

General Directorate for the Regulation of Gambling (DGOJ) published last Friday, October 16,

the Quarterly Report corresponding to the second quarter of the year, which coincides with the months of April, May and June, a time in which the sector almost entirely lived -as all- the such an extraordinary situation of the declaration of the state of alarm due to the coronavirus, which began on March 14 and that two weeks later was accompanied by the adoption of urgent complementary measures in the social and economic sphere.

Next, we analyze the data from the Report, putting them first in the right context, to finally try to answer the big question about how the toughest period of the pandemic affected the online gaming industry in which both the habits of citizens as the advertising activity changed dramatically.

A quarter marked by the State of Alarm

To face this new scenario and in the middle of a State of Alarm for COVID-19, on April 1, the spanish Government released the set of measures in relation to publicity and the promotion of state-level gambling. A series of actions that, as we have learned later, were taken as a reference to drastically harden the first draft of the

Royal Decree on Commercial Communications of Gambling Activities.

Thus, to frame the data that appear in the Report for the Second Quarter of 2020, we must add to the confinement of the population as a result of the declaration of national quarantine -which came into effect at 00:00 hours on Sunday, March 15-, everything that was included in article 37 of Royal Decree Law 11/2020 on the occasion of the Covid-19 Pandemic, where under the title “Measures of restriction to commercial communications of entities that carry out a regulated gambling activity in the Law 13/2011, of May 27, regulating gambling ”, established, among other things,“ to prohibit all promotional communication aimed at attracting new customers or loyalty of existing ones ”and to eliminate the emission of“ commercial communications in the audiovisual communication services, except in the time slot between 1 and 5 in the morning".

From that moment, the main promotional actions used by the industry disappeared from the web pages, affiliates and from the emails that were sent to the clients themselves (we are talking about bonuses, discounts, gambling gifts, improved odds, prize multipliers ... ) and advertisements on television or radio were limited to the early morning slot (1am-5am).

As Minister Garzón himself recognized, the reason for these measures was "the protection of minors and vulnerable people, who in the new scenario of forced residence at homes was understood to be necessary to establish special control and as a way of preventing risks that this could entail ".

Deposits, withdrawals and Operator's Gross Margin (GGR)

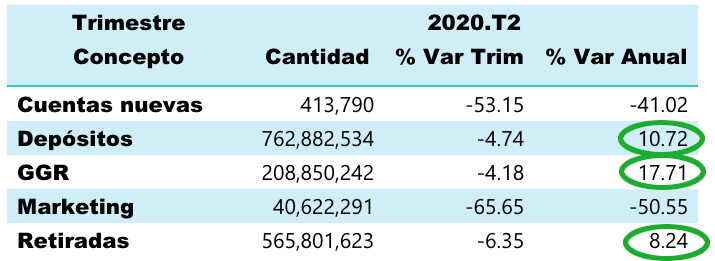

First of all, we focus on the three data that act as the most immediate marker of the operators' activity and that in this case qualify the impact of the measures taken by the Ministry:

- The Gross Gambling Margin or GGR

- Deposits

- Withdrawals

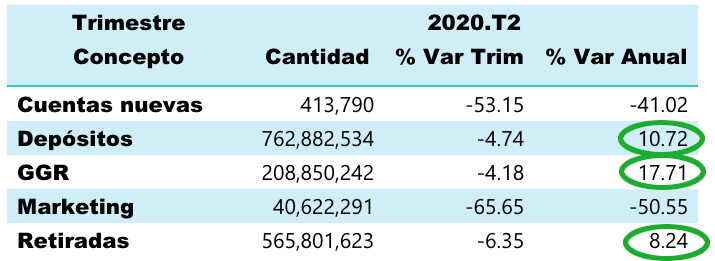

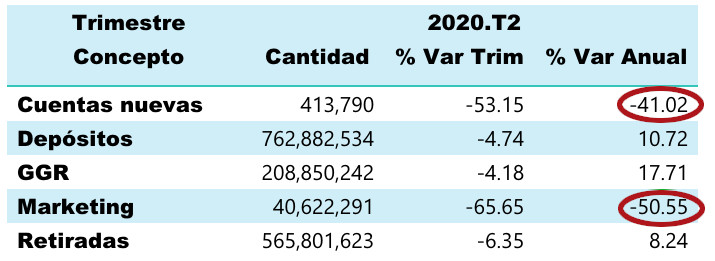

In all three cases we observe the same trend: taking into account the annual variation, the figures grew between April and June compared to the same period in 2019.

Specifically, the gross margin or Gross Gaming Revenue reached 208.8 million euros despite the fact that -as we will see later- the product that for 4 years had led the income of the operators (sports betting) reduced its participation in these around 21% due to the absence of sports competitions for much of the quarter.

In the graph above we effectively see that the gross gambling margin (GGR) -the variable that reflects the amounts wagered by users once the prizes awarded have been discounted and, therefore, supposes the amount that remains in the power of the operators- was down 4.18% compared to the first quarter of 2020.

The other two variables more related to gambling activity - player deposits and withdrawals - decreased their variation rates with respect to the previous quarter by -4.74% and -6.35% respectively; although also in annual variation they showed growth close to 10%.

New customers and operator´s investment on marketing

However, two closely related variables fell historically as such a sharp decline had never been seen since the start of the regulated market in 2012: marketing spending and the number of new accounts.

In other words, due to the impact of the almost total abolition of advertising actions aimed at acquiring new players, it was "a mission impossible" for operators in this context to get new players.

Specifically, the investment in marketing in the quarter was 40.62 million euros, which shows a quarterly decrease of -65.65% and broken down into affiliation expenses 6.66 million euros; sponsorship 4.32 million; promotions 12.47; and advertising € 17.16 million. Compared to the same quarter but 2019, this expense is further reduced: -65.65% (with a decrease in promotions by -70.55% and advertising by -71.19%).

Performance by gambling product

Returning to the

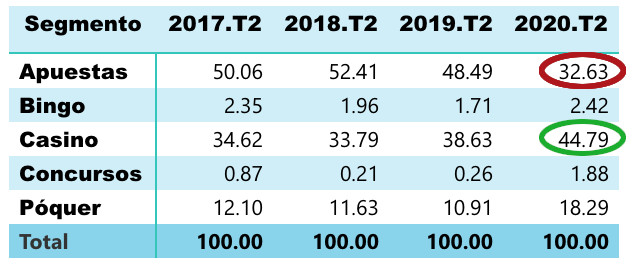

GGR, the most relevant data that we can look at to understand the evolution of the market, we observe the forceful impact that the forced stoppage suffered by all sports competitions in the world had on the gaming offer. And it is that the sports betting segment in that second quarter shows a decrease rate compared to the previous quarter of -38.38% and -20.79% compared to the same quarter of the previous year.

- In the casino segment there has been a growth of 22.55% compared to the 1st quarter of 2020 and an annual variation of 36.48%

- Bingo, for its part, posted a growth of 36.96% compared to the previous quarter and 66.89% compared to the same quarter of 2019.

- Poker presented this second quarter of 2020 a considerable increase of 57.84% compared to the previous quarter and 97.35% compared to the same quarter of the previous year.

The online sector: undamaged by the crisis but sensitive to the restriction of advertising

After the data provided so far, we are clearly in a position to affirm that the exceptional situation experienced in this second quarter has not affected both the online sector and the land-based sector at all, in fact taking data such as the GGR and sharing it in an annual rate, the online gambling market continues to show solidity en Spain, it is even capable of growing annually.

In fact, what shows the vigor of the sector is that given the scenario of having seen the sports betting offer almost disappear for more than two months, operators have been able to boost other segments and keep their clients active. In this way, it has become clear that the large online operators are obliged to cut their traditional excessive dependence on the betting product.

Stock price of the giants of the sector

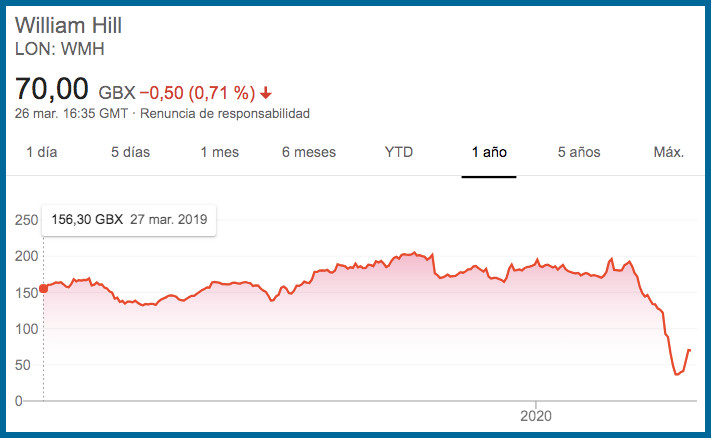

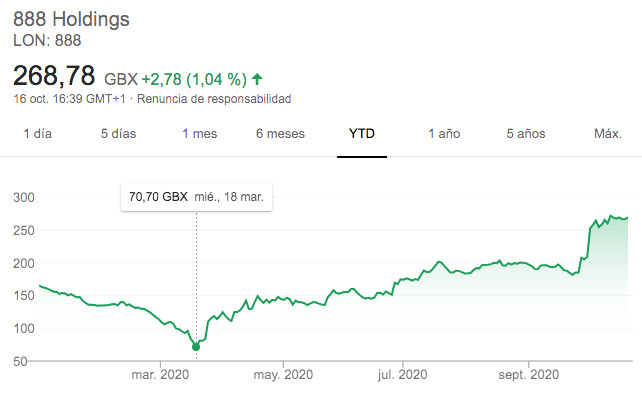

Despite the obvious and alarming drop in the value of listed online gambling companies during the first days of the health crisis, operators have been recovering and in just two months most of them already saw their share prices surpassing the price prior to the month of March.

William Hill and his crash when the first effects of the pandemic were known in mid-March 2020

This recovery - evident in the data of

GVC,

Flutter,

William Hill and

888 Holdings on the London Stock Exchange - has even made it possible that in the last part of the year, there is a firm conviction of greater activity in corporate operations that will surely go to further strengthen an industry that for now has emerged unscathed from the radical change that has occurred in our society in recent months.

888 Holdings Shares: Rising from 70p in Mid-March to Over 268p Today

To review more data on the Second Quarter Results provided by the DGOJ, click

HERE

18+ | Juegoseguro.es – Jugarbien.es