The American Gaming Association (AGA) has released the April 2022 Commercial Gaming Revenue Report, presenting financial performance data by state and nationally with breakdowns by individual gaming verticals.

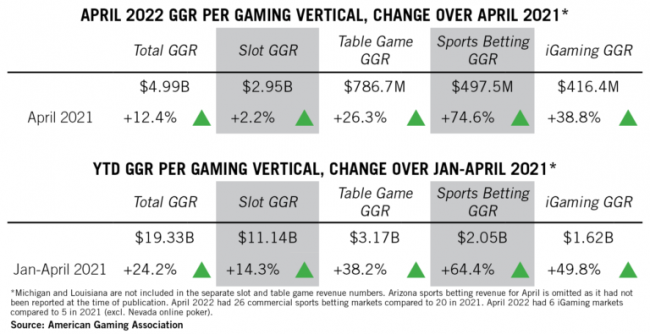

AGA highlights that U.S. commercial gaming revenue grew in April across all verticals to $4.99 billion, up 12.4% year-over-year and marking the second-highest-grossing month of all time despite widespread macroeconomic challenges.

According to the association, as expected, the year-over-year pace of revenue growth continued to slow in April as the comparisons move beyond 2021 months in which the industry was operating with significant COVID-related operating restrictions. On a sequential basis, gaming revenue dropped 6.8% from March's all-time monthly record.

Through the first four months of 2022, commercial gaming revenue stands at $19.33 billion, 24.2% ahead of the same period last year. While persistent macroeconomic concerns remain, including supply chain disruptions, labor shortages and rising inflation rates, the gaming industry's growth rate at the start of 2022 has the potential to be another record-setting year.

Through April, nearly all commercial gaming states are tracking well ahead of where they were at this point in 2021. Bucking that growth trend is the idiosyncratic D.C. sports betting market (-32.0%), as well as Kansas (-0.3%), Mississippi (-1.2%) and South Dakota (-1.6%) that are down by low single digits from last year’s pace.

We should note that the increasingly difficult year-over-year comparisons were felt strongly in the legacy casino markets of Mississippi and South Dakota and reflect the strength of the consumer gaming market in spring 2021 as operating restrictions were lifted.

On the other hand, the AGA explains in a press release that Casino visitation levels were down year-over-year in April in four of the five states that report admission data (IL, IA, LA, MS, MO). Mississippi casinos registered the largest decline (-12.9%) while Illinois casinos welcomed the highest number of visitors – 806,302 – since before the pandemic. Compared to pre-pandemic levels, visitation was down in April an average of 12.3% across the five states.

Meanwhile, Las Vegas outperformed the regional markets as visitation jumped 31.4% year-over-year and was merely down 4.5% from April 2019, according to the Las Vegas Convention and Visitors Authority.

In April, combined gaming revenue from land-based slot machines and table games grew in 20 of 25 states compared to 2021, while year-to-date revenue from such traditional casino gaming is down in three markets: Kansas (-0.3%), Mississippi (-1.3%) and South Dakota (-2.1%).

Nationwide, traditional casino games generated revenue of $4.07 billion, up 5.7% versus April 2021. Slot revenue gained 2.2% to reach $2.95 billion, while table games generated revenue of $786.7 million, a 26.3% increase over 2021.

As far as sports betting and iGaming revenues are concerned, they continued to grow by double-digit percentages in April throughout 2021.

Land-based and online commercial sportsbooks generated $497.5 million in revenue from operations in 25 states, excluding Arizona, which had not yet reported sports betting data at the time of publication. This represents a 74.6% gain from April 2021 when commercial sports betting markets were live across 20 markets. Excluding new sports betting markets, April sports betting revenue was up 67.9% year-over year.

Meanwhile, iGaming platforms in Connecticut, Delaware, Michigan, New Jersey, Pennsylvania and West Virginia generated $416.4 million in April, $6 million short of March's record revenue and up 38.8% year-over-year. April 2022 had six iGaming markets compared to five in 2021 (excluding Nevada online poker). Omitting the new iGaming market, April iGaming revenue was up 31.2% year-over year

Taken together, gaming revenue from iGaming and online sports betting reached $913.9 million, or 18.3% of all commercial gaming revenue in April, a decrease from 19.2% in March.

18+ | Juegoseguro.es – Jugarbien.es