The UK

Gambling Commission published last Friday an extension of the preliminary study that it had already released but in which much more data is discovered that shows the impact of the situations caused by Covid-19 on the behavior of the game of British citizens.ç

The data reflects the situation experienced in the first full month of confinement and closure of establishments in April, with information collected from the most important online operators and the YouGov Covid-19 search engine that tracks the evolution of visits and the impact of pages. website in recent weeks, covering a representative sample of around 2,000 adults in Britain and at the operator level, covering approximately 80% of the entire online gaming market.

The study begins with the update of the data published by the Gambling Commission itself on May 12, after which an updated guide for operators was issued, which included the need for better accessibility controls, the prevention of reverse withdrawals and restrictions on bonus offers.

Broadly speaking, it can be seen how the general participation of players has decreased, but some specific players have invested much more time and money in gambling in certain products, especially poker and virtual betting, which are the segments that have grown the most .

This is why the Gambling Commission asked operators as early as May to strengthen monitoring and guidance systems for their players, thereby ensuring that people are more protected from harm.

But in this new part of the report, with complete data corresponding to the month of May, the Gambling Commission emphasizes various relevant events:

- The Covid-19 pandemic continues to affect consumer behavior, in addition to generating major impacts in the gaming industry.

- Among the general consumer trends, it is highlighted that 23% of the population feels that their general mental health has been negatively affected. There has also been a significant financial impact, with the same research pointing out that 39% of people have seen their disposable income decrease.

- Important changes are observed in the way of enjoying entertainment activities. This is particularly true among people who play. According to YouGov data as of May 7, those who had played in the past four weeks were more likely than the national average to:

a) spend more money online (17% of gamers compared to 12% of all adults)

b) watch more television (56% of players compared to 43% of all adults)

- Regarding the impact of the gaming market, knowing that since March 20, all retail gaming establishments closed, it meant that activities that normally generate 50% of the general market (excluding lotteries) stopped. In general, it was observed that fewer consumers are playing, highlighting, for example, that only 0.2% of all the adults interviewed stated that they had started to play for the first time in the last four weeks. This compares to 2% of adults who had stopped playing during this period.

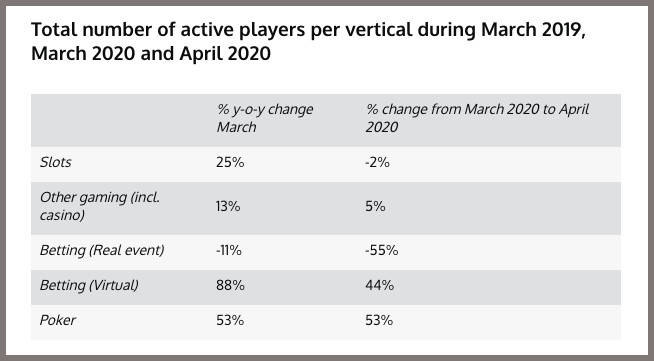

- Operator data on overall active player accounts indicates a 5% decrease between March and April 2020, driven substantially by betting on real sporting events (active players down 55%), and reflects the lack of high quality sport during April. Although fewer consumers participate in sports betting, the data indicates that participation has not decreased as dramatically as anticipated at the start of the crisis.

- But at the same time, some people, who are already playing, are testing new products, so there has been a shift towards more online activities. During April 2019, 26% of consumers seemed to participate in more than one online activity, a figure that increased to 42% during April 2020.

- The period analyzed has also shown an increase in the range of activities for some; YouGov research shows that around a third of players in the past four weeks say they have attempted one or more gaming activities for the first time during the crash [9]. This figure rises to more than half (54%) of committed players, that is, those who have participated in three or more gaming activities in the last four weeks, with 18% of this group having attempted to bet on virtual racing or sports and a similar ratio trying online bingo for the first time in the last four weeks. The new core activity is National Lottery draw-based games, with one in five recent players claiming to have played National Lottery draws for the first time in the past four weeks.

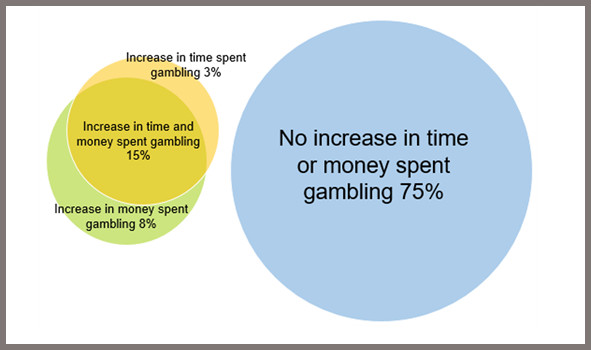

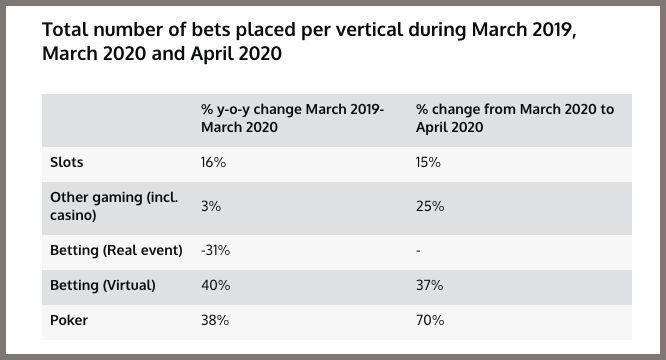

- In general, players claim to be playing products at the same rate or less, but most of those who have participated in 3 or more gaming activities in the last four weeks claim to be spending more time or money on one or more activities. This is reflected in the growth in the average number of bets per customer on some products.

Total number of bets placed by vertical during March 2019, March 2020 and April 2020

- The volume of activity in certain products seems to continue to grow. We have seen a slight change compared to our last report, for both slots and casino products, which are the most important parts of internet gaming. As the numbers of active players grow, the number of bets placed now grows at a faster rate. This indicates an overall growth in the product and an increase in the average number of bets per customer.

- This change is in the context of relatively stable advertising awareness, where YouGov research shows that 34% of adults remember seeing commercial communications for online bingo, casino, or slot games in the past four weeks. This is comparable to 39% in our pre-closure investigation for the Coronavirus.

- In general, players claim to be playing products at the same rate or less, but most of those who have participated in 3 or more gaming activities in the last four weeks claim to be spending more time or money on one or more activities.

- The profile is different for committed players. More than six in ten (62%) have increased the amount of time or money they have spent on at least one gambling activity, including National Lottery products, noting that this does not necessarily mean that the time or money they spend have spent overall All gambling has increased. There has also been an increase in the number of sessions of more than one hour.

- Between March and April 2020, the average session length reported by operators has not changed. Within that, the number of sessions that lasted more than an hour increased to 2,274,521. This means that the proportion of sessions lasting more than an hour is maintained at around one in eight.

Read the full report

HERE

18+ | Juegoseguro.es – Jugarbien.es