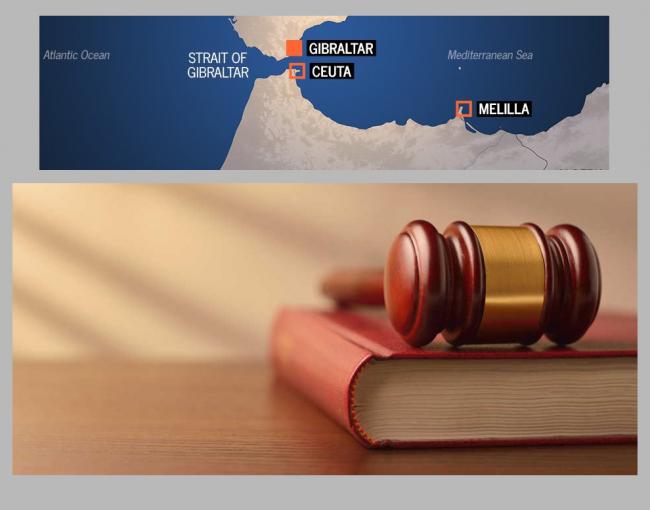

What is currently one of the most dynamic industries of the Autonomous Cities, technological and related to online gambling, needs to have a categorically clear legal and fiscal framework. That is why Ceuta and Melilla have asked the central executive that there be no room for interpretation in tax-related disputes such as the one that Bwin recently starred in, forced by the Tribunal Supremo (Supreme Court) to pay VAT for activities carried out in Gibraltar.

In addition to the initiatives that we have already mentioned in

Ceuta on the formation of human capital and the request for European Funds to build a building that houses common services for companies in the sector, the two autonomous cities -Ceuta and Melilla- have made an appeal to the Executive central and the General Courts to guarantee another of the imperative needs of technology companies in general - and those of the online gaming sector in particular - to develop their activities properly:

legal security in terms of taxation.

The petition revolves around controversial Supreme Court judgments that forced

Bwin to levy VAT tax in accordance with the provisions of the Spanish VAT Law itself, despite the fact that the operations subject to this tax were carried out from Gibraltar.

What Ceuta and Melilla are requesting is that any hint of the use of the interpretation criterion in the current VAT Law be eliminated, especially in relation to the levying of this tax on company operations located in the two autonomous Spanish cities in North Africa .

Respect for the special Economic and Tax Regime (REF) that Ceuta and Melilla have and make clear the taxation of services subject to VAT in advertising, consulting, marketing and advice provided by a company established in the territory of application of the tax, even if the company receiving the services is another that is not established in said territory, these are the messages that are to be reinforced to ensure that there is no doubt that the reality applied in the case of bwin and Gibraltar would not occur at all. forms the two Spanish towns.

A clear fiscal environment with no surprises

What is being sought is the ratification of a clear protocol that has served to provide an appropriate legal and fiscal framework according to the very special circumstances of the two territories.

And it is that the autonomous cities, far from being tax havens, have a special tax regime that also forces them to fight with the main problems that both the Administration and taxpayers and companies may have; Therefore, avoiding double taxation and preventing income tax evasion are noble objectives in which Ceuta and Melilla have been committed.

The bwin case in Gibraltar and the Supreme Court ruling

Cracking down on Gibraltar-based companies using tax strategies to avoid paying taxes in Spain is certainly what prompted the Spanish Supreme Court to investigate some alleged economic crimes committed by gambling companies in Gibraltar. However, the approach to support and tax the industry in Ceuta and Melilla distance the autonomous cities from that reality.

Specifically, the judgments to which we refer are those that have as protagonists Bwin and other operators based in Gibraltar, who were requested to pay VAT in application of the rule of actual and effective use of the services offered to third parties. Without a doubt, the case of the popular sports betting and online gaming company that sponsored Real Madrid for almost five years is the most significant since it has had to pay more than 970,000 euros in VAT for various advertising and consulting services. And the Court has confirmed that these services were carried out by the company's online gambling division, based in Gibraltar, and that therefore this amount should have been paid in the VAT settlements corresponding to periods between 2008 and 2012 by Bwin Interactive Marketing Spain, registered in Spanish territory. And most importantly: the advertising services and the other services carried out to attract customers who participate in online games organized by the parent company based in Gibraltar, have been given and used in Spanish territory.

As should be clear, Ceuta and Melilla are not affected at all by these judicial decisions since, unlike Gibraltar, considered for all purposes a tax haven and does not have the supervision of the Spanish Treasury, companies in Ceuta or Melilla pay their taxes and are adequately controlled by the Spanish Tax Agency, so that in both locations VAT is not paid but its special REF is applied.

18+ | Juegoseguro.es – Jugarbien.es