The General Directorate of Game Management published the first quarterly report of the year yesterday, Tuesday, June 27th. Without a doubt, supported by other publications and studies carried out by the Regulator, it is the tool that best exposes the sectoral reality in the online gaming sector.

We at InfoPlay review the figures that have varied most significantly and how the sector has behaved in the complicated first months of the year, marked by unfavorable macroeconomic variables and the slowdown in sports activity after the momentum brought by the 2023 World Cup in Qatar in the final weeks of last year.

Where do we come from?

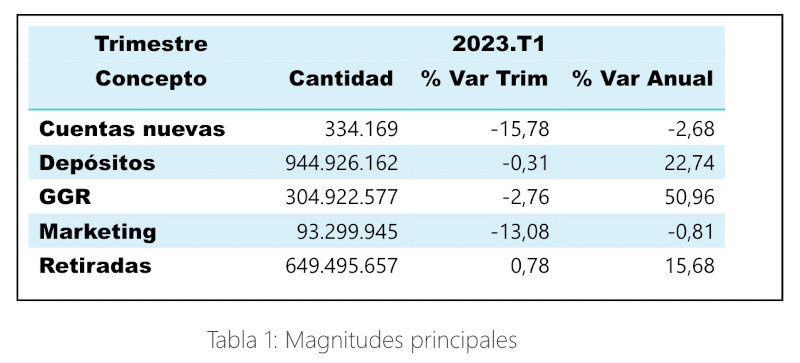

As always when analyzing the data provided by the DGOJ in its Quarterly Reports, they are compared with the immediately previous Quarter (in this case with the 4th Quarter of 2022) and the annual variation is highlighted by comparing them with the figures of the same quarter of the previous year (in this case the 1st Quarter of 2022).

Therefore, it is worth remembering that the last quarter of 2022 represented a significant increase in all the variables analyzed, including those that had been falling for almost two years such as investment in marketing and advertising or the number of new accounts.

Specifically, the GGR of the 4th Quarter of 2022 was 313.31 million euros (exceeding by 27.27% the figure of the 3rd quarter of 2022 and by +78.16% compared to the 4th Quarter of 2021). The reasons for this excellent result are explained by the spectacular strength of the Sports Betting vertical that, supported by the celebration of the Qatar World Cup, increased its GGR by 50% compared to the previous quarter.

Operators' Gross Income holds up supported by casinos and bets

The first magnitude to highlight in this Report with data from January to March 2023 is the quarterly GGR, which is almost 305 million euros (304.92), confirming what was expected, a reduction compared to the previous quarter. In this case, the decrease is around -2.76% compared to the fourth quarter of 2022 in which we insist the Football World Cup was held in Qatar.

In any case, the increase in Gross Gaming Revenue (GGR) in this first quarter of 2023 is almost 51% (50.96%) compared to the first quarter of 2022. This trend is also reflected in other key figures, where player deposits and withdrawals show a clear upward trend on an annual basis, although they reflect a nearly identical figure compared to the previous quarter.

Verticals: Casino dominates

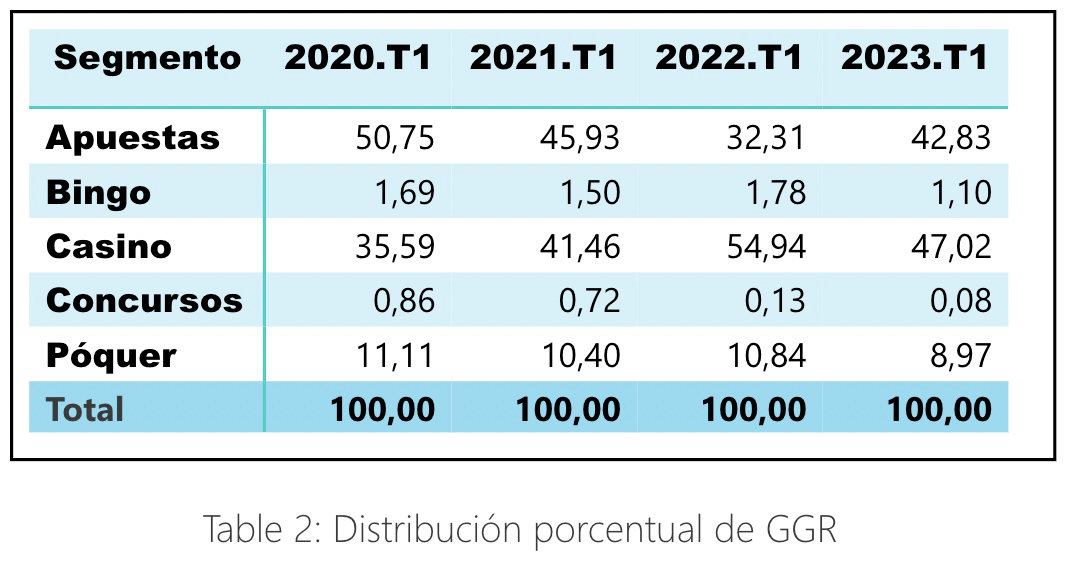

When analyzing the GGR by game segments, it can be observed that sports betting continues to strive to surpass the casino as the leading type of game. However, it experienced a decrease compared to the previous quarter, similar to casino and poker. This can be attributed to the reduced post-World Cup activity, which significantly boosted the sports betting segment in the last quarter of 2022.

The reality is that

casino games (slot machines and live roulette) still account for nearly 50% of the GGR generated in the sector.

Specifically, out of the €304.92 million in Gross Gaming Revenue (GGR), €130.60 million is generated in Sports Betting (42.83%); €3.35 million in Bingo (1.10%); €143.36 million in Casino (47.02%); €0.25 million in Contests (0.08%); and €27.36 million in Poker (8.97%).

The

sports betting segment has a decrease rate of -7.65% compared to the previous quarter and an increase of 100.10% compared to the same quarter of the previous year. Conventional sports betting decreased by -11.21%, and live sports betting decreased by -6.11% compared to the previous quarter. Horse racing betting decreased by -5.92%, while other sports betting increased by 37.76%.

Bingo has experienced a decrease of -7.40% compared to the previous quarter and -6.62% compared to the same quarter in 2022.

In the

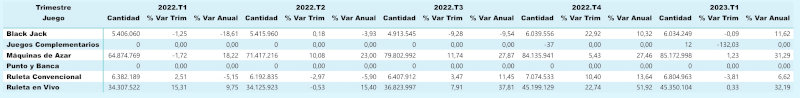

casino segment, there has been a growth of 0.64% compared to the fourth quarter of 2022 and a positive annual variation rate of 29.19%. This annual growth is observed in slot machines with 31.29% and live roulette with 32.19%. Compared to the previous quarter, slot machines increased by 1.23%, live roulette by 0.33%, while conventional roulette decreased by -3.81%. This information is shown in the following table.

Contests experienced a 730.40% increase in this quarter and a -4.89% decrease in the annual variation rate. This segment displays irregular behavior with annual variation rates of 99.50% in 2020, -7.59% in 2021, and -85.15% in 2022.

In the first quarter of 2023,

poker saw a 5.01% increase compared to the previous quarter and a 24.92% increase compared to the same quarter of the previous year. Tournament poker activity and performance increased by 8.42% compared to the previous quarter, while cash games decreased by -2.72%.

Active Operators

In this analyzed first quarter of 2023, out of the 78 operators who still hold licenses, it is estimated that over 80% have been active.

For example, out of the ten operators with a "

Poker" license, only Aconcagua is considered inactive, while 888 Poker, Winamax, PokerStars, Sportium, PartyPoker, Bwin, Bet365, Casino Barcelona, and Betfair continue to offer gameplay in both tournament and cash game modes, as well as other authorized variants.

In

Bingo, all three operators holding licenses remain active: Gamesys Spain with Canalbingo.es and Botemania.es, Tombola International Malta (Tombola.es), and Bingosoft (Yobingo.es).

Sports betting, with 43 active operators, and especially casino operators, with 51 licenses, continue to represent the majority of gambling activity in Spain. The surprise in this first quarter of 2023 comes from the fact that the only two active license holders experienced a 730.40% increase compared to Q4 of 2022, significantly reducing the annual dramatic decline, which now stands at -4.89%.

Therefore, operators such as euroconcursos.es or eurojuego.es/eurojuegostar.es have been able to continue capitalizing on their licenses by organizing interactive contests in various media outlets (radio, television, press, and the internet) and also targeting sectors such as restaurants or large retailers.

Marketing Investment

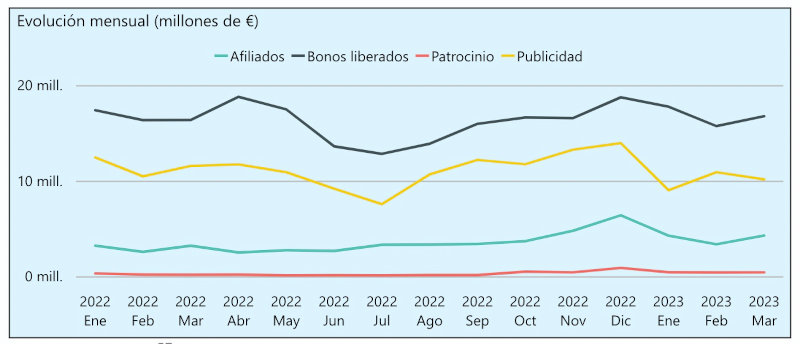

Marketing spending continues to decline with a -13.08% decrease compared to the previous quarter. Regulated operators have accounted for a total investment of around €93.30 million, with

affiliate payments amounting to €11.86 million,

sponsorships only reaching €1.22 million, and promotions totaling €50.19 million, which is the largest segment in marketing.

Advertising in traditional media outlets also remains significant, amounting to €30.03 million.

These figures, when compared to the same quarter of 2022, show little variation (-0.81%), but it represents a constant annual decline. Advertising expenditures present negative rates compared to the previous quarter and the previous year, with decreases of -22.79% and -12.75%, respectively.

- Expenditure on affiliates decreased by -19.90% compared to the previous quarter but increased by 32.45% compared to the previous year.

- Expenditure on sponsorships decreased by -30.48% compared to the previous quarter but increased by 93.18% on an annual basis.

Promotions decreased by -3.26% compared to the previous quarter but increased by 0.27% compared to the previous year.

Naturally, the correlation between the decrease in advertising investment and the number of new players translates into a decline of -15.78% in new accounts compared to the previous quarter. Specifically, there were 111,390 new users recorded, which also represents a -2.68% decrease in new accounts on an annual basis.

Given the challenges of attracting new customers, operators' strategies and retention promotions contribute to maintaining an average monthly total of 1,158,628 active accounts, which represents a -2.57% decline compared to the previous quarter but a positive annual variation of 11.06%.

To access further information, the DGOJ has already updated the webpage where the most relevant data discussed in this Quarterly Report can be viewed and downloaded.

Click HERE.

18+ | Juegoseguro.es – Jugarbien.es