The Spanish Regulator (DGOJ) has just released its annual report on the profile of players in the Spanish regulated market. Discover in this detailed summary who the average player is, their level of activity, and all the preferences of registered players across different national operators.

The General Directorate for the Regulation of Gambling (DGOJ) has recently published its updated annual report, which provides information about the characteristics and behavior of online players in Spain.

The report offers valuable information about the average Spanish player in the online gambling market, especially when comparing their data with those from public gambling (such as Quiniela and Lotería) or ONCE (National Organization for the Blind).

What does this report analyze?

Yesterday, on Tuesday, June 27, the DGOJ updated one of its most valuable studies for understanding the reality of gambling in Spain: the annual report on the PROFILE OF THE ONLINE PLAYER in our country, based on data collected in 2022.

Although we recommend consulting the complete report, we would like to highlight some of the most prominent variables that justify the growing discontent among operators regarding how certain groups, led by the Ministry of Consumer Affairs, describe the sector.

In summary, the report by the DGOJ sheds light on the average Spanish online player, their level of activity, and their preferences within the regulated gambling market. This information is valuable for operators and policymakers to understand the dynamics of the online gambling industry in Spain and make informed decisions.

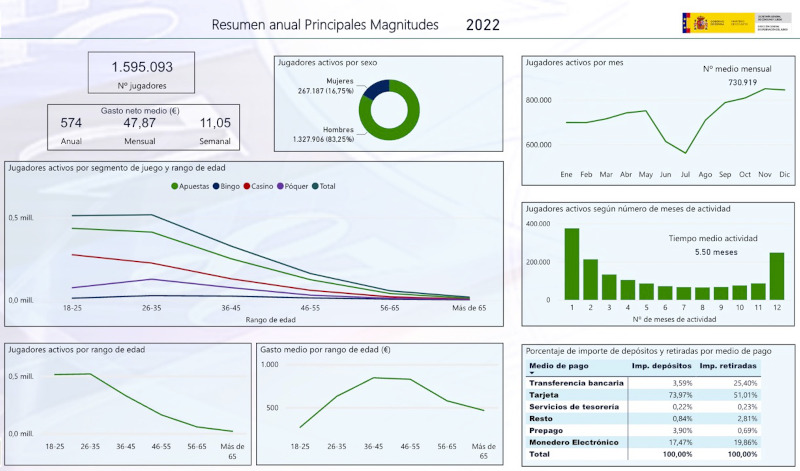

As we can see in the above graphs, focusing on the most significant figures, the average Spanish online player tends to be a male adult between the ages of 25 and 35, with an average monthly expenditure of less than €48. They primarily use debit cards for making deposits and engage in online entertainment with nearly 1,600,000 Spaniards.

Beyond the significant gap in the distribution between male and female players, the reality regarding spending levels is that the majority of players participate in online gambling occasionally rather than regularly.

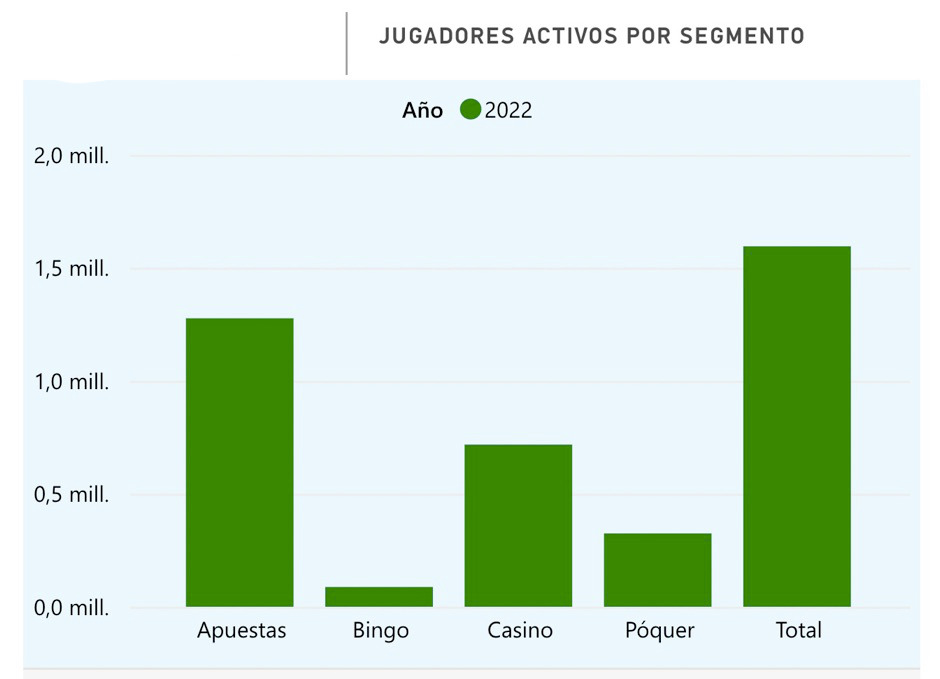

Regarding preferences, the report highlights that sports betting and casino games (live roulette and slots) are the most popular forms of online gambling among Spanish players.

The socio-demographic analysis of players (based on segmenting activity and game type by gender and age) has become less significant in this type of study, with expenditure now being the variable that should be emphasized when comparing it with spending on games offered by SELAE (Spanish State Lotteries and Bets) and ONCE (National Organization for the Blind). For example, the number of players participating in the National Lottery (76% of adults) and their average spending on draws such as the Christmas Lottery (exceeding €100 in many regions) outweighs the regulated online gambling in absolute terms.

Regarding payment methods, 74% of players use their bank cards (VISA or Mastercard), demonstrating that the arrival of Bizum and the impact of other electronic wallets (such as PayPal, Skrill, etc.) have not managed to surpass the traditional payment method associated with entertainment and e-commerce.

Activity in Spain

The report establishes a base figure of 1,595,093 active players for calculating purposes, representing an annual growth rate of 8.44%. Of these players, 83% are men, and over 85% are between the ages of 18 and 45. Beyond the clearly defined profile (males aged 18 to 45), when examining the game segments, sports betting (particularly live betting) is favored by the majority of citizens, followed by the two leading casino games (slots and live roulette).

Despite the tax implications that discourage professional players from fully dedicating themselves to poker in Spain, its activity has remained consistently stable since 2012.

It is worth noting that only 386,411 new players were recorded in 2022, highlighting the difficulty of attracting new customers through mass communication campaigns due to the Real Decreto de Comunicaciones Comerciales (Royal Decree on Commercial Communications). However, in the past year, with the World Cup as a catalyst, it is estimated that the figure is much higher than what is expected for 2023 and 2024.

Moderate spending

The aforementioned average expenditure of €574 per year (less than €48 per month and about €11 per week) is one of the most important figures reflected in the report, showing moderation and stability over the past five years. Unlike the calculation method used in SELAE games, this data is much easier to obtain: by subtracting withdrawals from deposits made by each player. Operators are obligated to provide this information at any time, enabling the creation of an Account History that also helps players meet their tax obligations in their annual income tax declaration.

The distribution of this expenditure and activity by vertical is extremely interesting for understanding the sector's situation, something that can be seen in the DGOJ's Quarterly Reports. In this report, they also attempt to uncover behavioral patterns among players, who predominantly show a willingness to play casino and bingo games together, although sports betting remains prevalent.

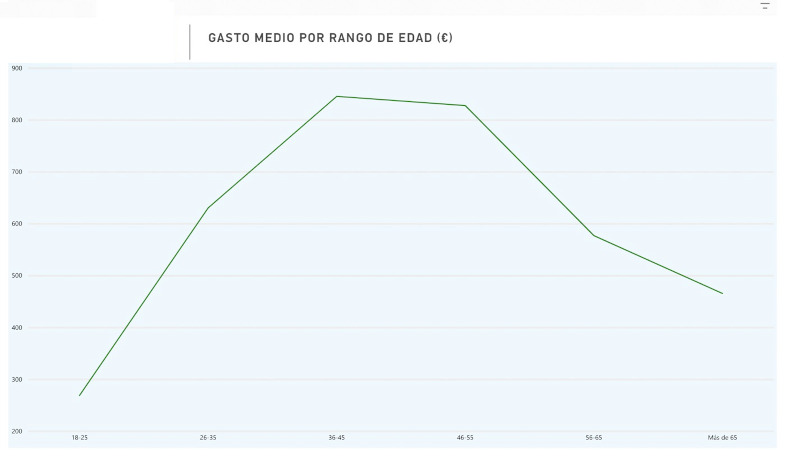

Returning to the average spending, we observe a clear difference based on gender. While men average €626 per year, women's average expenditure drops to €320. Additionally, we see higher spending among individuals aged 36 to 45, while young people aged 18 to 25 barely reach €269 annually.

Spending Ranges

Lastly, perhaps the most noteworthy data from the report is the correlation between spending ranges and the total number of players, which, as we have seen, does not exceed 1.6 million citizens.

Unlike SELAE games, in the private online gambling sector, up to 20% of players end the year with net profits, while 80% experience losses, although most of these losses are relatively low (less than €100 for the vast majority).

Let's remember that the probability of winning in National Lottery draws is extremely low, with games such as Quiniela, where the probability of hitting the jackpot is one in almost five million, or Lotería Primitiva, with a probability of one in 14 million, or El Cuponazo, with a probability of one in 15 million.

Although it may not be clearly visible, the graph shows the net variation (gain - loss) experienced by players in 2022. We observe that 619,793 players in 2022 (38% of the total) had losses ranging from 0 to 100 euros per year, while 10% of players had gains within the same range (0 to 100 euros).

In the highest range of losses and gains, we see that 102,266 players (6.4%) lost more than 3,000 euros in the year, while 23,177 players (1.5%) ended the year with profits exceeding 3,000 euros.

In summary, the DGOJ report sheds light on the average Spanish online player, their level of activity, and their preferences within the regulated online gambling market. This information is valuable for operators and stakeholders of all kinds to understand the dynamics of the online gambling industry in Spain and make informed decisions.

However, it is quite challenging to draw demographic and sociological conclusions from specific data in the report, as the Ministry often does. Nevertheless, by comparing the data with Loterías and ONCE, we can conclude that, considering the main figures such as player deposits and withdrawals, the average Spanish player exhibits a profile characterized by prudence and moderation.

18+ | Juegoseguro.es – Jugarbien.es