Since 2012, when explicit regulation of online gambling began in Spain, until the end of 2023, we have witnessed a process in which the market has reached maturity. In addition to established operators and regulatory development starting from the 2012 Gambling Regulation Act, the player base is more informed and has changed its preferences. We review how the player experience has evolved over this time and what the immediate future is expected to look like.

The online gaming market in Spain has experienced significant changes since its regulation in 2012.

After analyzing them from the operators' point of view in the

First Part of this INFOPLAY SPECIAL, we now focus on their impact on players. The technological and product development, diversification in communications, fashions and trends in entertainment and content consumption, or the new restrictions in advertising have also affected customers, presenting a complex and nuanced panorama in the near future.

We divide this analysis into two parts, the first focused on the characteristics and review of what happened from 2012 to 2021, and then discover the trends and present reality and what is expected for 2024.

2012-2021: Initial shock and emphasis on the recreational player

At the beginning of the regulated gaming market in Spain (from late 2011 to the summer of 2012 with the start of activities by the first operators), we witnessed an initial shock from events that had not occurred until then, with the player as the main actor.

Especially in

POKER, where a regulation based on shared liquidity led to the exodus of hundreds of professional players to other countries (United Kingdom, Portugal, or Malta). In this way, we could see how the new legal gaming offer did without the player profile that earns the most money and generates the most commissions for operators. Something that, with a lesser impact, was replicated in the

EXCHANGE BETTING modality (with two operators at that time like Betfair and Carcaj competing in this betting vertical niche).

In any case, recreational players enjoyed the first months and years of the regulated market with generous welcome promotions (bonuses), competitive loyalty programs, and a product offer that kept growing as regulation allowed. Thus, from only roulette, blackjack, and baccarat as authorized casino games, it progressively moved to the current reality, with roulette and gaming tables with live dealers, thousands of slots from dozens of providers, and endless formats of sports betting and poker games.

Also, parallel to the regulatory demands that forced operators to offer control and security tools, the main initial problem reported by players (cases of identity impersonation and/or sale of accounts on the black market) disappeared with legislative innovations in the field of safe and responsible gaming.

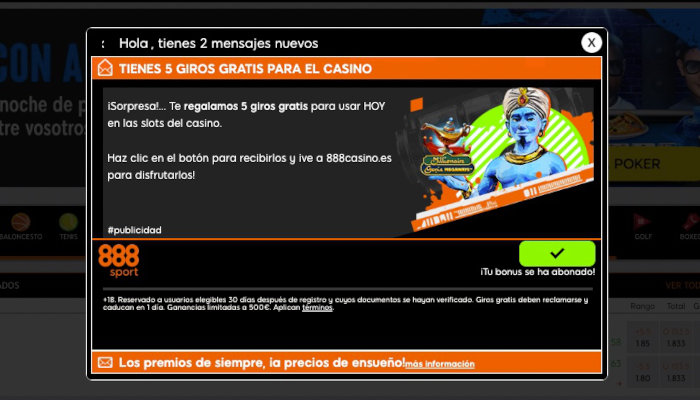

Another aspect to consider, even in the years prior to 2019 with specific intervention in the matter, was the reduction of invasive advertising that had characterized the sector in the years of alegal gaming (2005-2011). Those were years when operators were governed by a code of self-regulation in advertising, in which cases like the advertisement of Carlos Sobera and 888.es were sanctioned under that regime.

Current Situation and Forecasts for 2024

Currently, the restriction on online gaming advertising has significantly reduced the advertising bombardment for players. This has created a less invasive environment and more focused on the game itself, rather than on the constant promotion of offers and bonuses. However, we can still find forms of marketing, especially in the field of affiliation that can be considered controversial.

For example, the live broadcasts of casino game sessions that even in 2023 could be followed on Twitch or the absence of limitations on Kick, the recent alternative to Twitch with channels like Zonagemelos, protagonist of news not beneficial for those platforms nor for their content creators.

Another seemingly very positive effect of the arrival and evolution of the regulated market was how the online advertising market itself (monopolized by Google, YouTube, and social networks like Facebook, Twitter, or Instagram) expelled unlicensed operators. Although it has not really been possible to completely eliminate the advertising or positioning of illegal operators, as demonstrated by the sanctions announced each year by the DGOJ.

Therefore, and unfortunately, we are still on the verge of 2024 with a transfer of users to unlicensed operators as is the case with the poker room GGPoker, which continues to have advertisers and affiliates promoting registration to Spanish players.

Beyond brand recognition and its impact on acquiring new players, the strict regulation of advertising and promotions has led to the disappearance of bonuses for new players and restrictions on promotional offers. This situation has changed the market dynamics, limiting incentives for new players and affecting their activity.

- Concentration in a few operators

In general, players have stopped evaluating different possibilities and no longer try out several operators successively. The absence of welcome bonuses disincentivizes having a dispersed bankroll, and most users of betting houses, online casinos, poker rooms, or "punto ES" bingos recognize playing only in one or two operators regularly.

Operators know this and, as we already warned in the

First Part of this SPECIAL, they focus on trying to get customers with a verified account to try other games within the same operator. This has had an impact on the player's experience, encouraging them to explore games outside their usual specialization or preference.

Additionally, it must be taken into account that current legislation limits access to any promotion to users considered "eligible," who are those with an account older than 30 days after registration and who have verified their account with documentation.

- Greater Protection for the Player

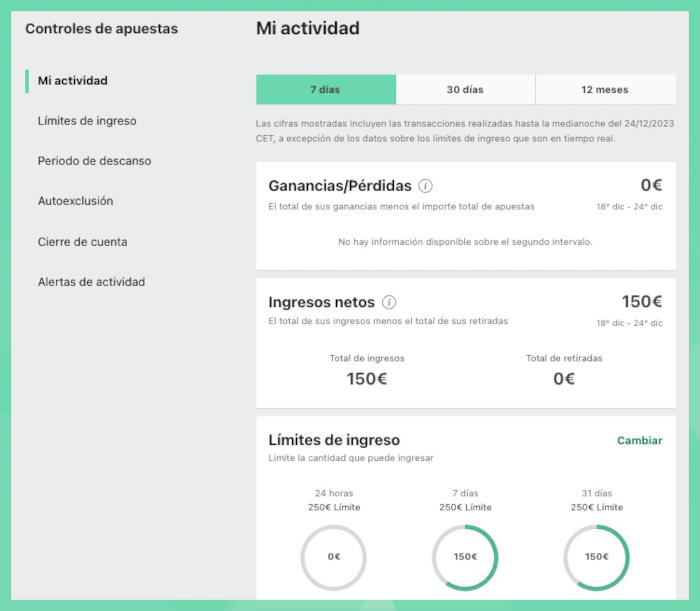

Regulations have increased security in terms of identity protection and payment methods. Measures include account verifications and spending controls, increasing the player's trust and security on online platforms. The downside of this protection is that it requires a verification process that, although accelerated, requires the player to provide documents or undergo real-time verification so that the operator can ensure that the identity document and payment methods belong to the account holder.

Faced with the requirement of a verification process, operators have preferred to eliminate unverified accounts after 6 months, understanding that they will not play. Although you can start playing without verifying the account, if you do not do so, you will not be able to access their promotions, withdraw funds from your account, or even deposit more than 150€.

- Limitation of Losses and Self-Exclusion

Limits on losses and self-exclusion tools have also been implemented to promote responsible gaming. This gives players more control over their gaming activity and helps prevent problems related to gaming.

- The Success of the Omnichannel Strategy

In recent years, players have benefited from the conveniences provided by operators with physical channels. This includes the possibility of interacting in a physical environment and the availability of additional gaming options and payment methods. Operators such as Codere, Luckia, Sportium, or the online brands of the most prestigious casinos and physical gaming groups in Spain have managed to stand out in the current context of advertising restrictions, offering proximity and trust to the customer who can also visit their physical entertainment centers.

- New Legislations to Come... from Inside and Outside the Gaming Sector

Although it was already clear with the Royal Decree on Commercial Communications and influencers, vloggers, or YouTubers can only offer commercial communications related to betting or gambling from 1:00 to 5:00 in the morning, the new

INFLUENCER LAW, like many other regulations, may affect the sector in the future. Thus, also in fiscal matters, measures could be being devised that expand the current obligation to report earnings in regulated gaming operators on an annual basis and include them in the income tax return.

- Awareness of Responsible Gaming

If anything can be acknowledged from these twelve years of the regulated market, it is the evidence that there is greater awareness of the risks of gaming and the importance of responsible gaming. Largely thanks to education campaigns and the policies of the operators. There is much more information about the activity of the players, and it is not just data used by the operators but is also available to the user in their gaming account.

In summary, the current situation of online gaming in Spain presents a mixed panorama for players. On one hand, regulations have led to greater protection and a safer, more responsible gaming environment. On the other hand, the reduction in promotions and the limitation on advertising have decreased opportunities for professional players and have made recreational players have fewer incentives to keep trying, staying loyal to one or two operators per product.

Despite these challenges, the sector continues to evolve, adapting to new regulations and seeking ways to maintain its appeal for players.

18+ | Juegoseguro.es – Jugarbien.es