Yesterday, March 13, 2024, the DGOJ published its annual report on the ONLINE PLAYER PROFILE. This document provides a clear view of the user in the regulated Spanish market, including their preferences and consumption habits. We analyze the presentation and offer 5 key conclusions that show how Spanish players interact with regulated products and operators.

The General Directorate of Game Management published yesterday, Wednesday, March 13, 2024, what we consider one of its most valuable reports of the year. It is about the Profile of the Online Player in our regulated market.

A study that offers a global vision of the users, their preferences, and consumption habits. After an exhaustive analysis of the

presentation available on their website, we extract 5 important conclusions that allow us to better understand how the Spanish player interacts with the market, the products, and regulated operators.

FIVE CONCLUSIONS

In the update with the 2023 data, the current report on the ONLINE PLAYER PROFILE of the General Directorate of Game Management reveals -in our opinion- five essential conclusions.

We believe that the report sheds light on key aspects of the behavior and preferences of online players and reveals part of the fundamental dynamics of gaming in Spain, allowing us to better understand the current landscape and emerging trends of the online sector. However, there are some conclusions that go beyond the data and should invite reflection.

1) Definitely, it is possible to approach a "Player Profile" or "Buyer Persona"

Unlike what happens with the client of ONCE or the games of SELAE, with information like the one published yesterday by the DGO, this fundamental concept in marketing and sales (Buyer Persona or Consumer Profile) can be applied to the private online gaming market.

This allows companies to better understand their potential customers and all the actors in the sector (affiliates, advertisers, media, agencies, suppliers...) to have a clear understanding of who the customer is, that is, the consumer of the final product (entertainment in the form of internet gaming).

After a decade of publishing an annual review of this report, we already have enough data for any actor interested in the sector to professionally and in detail, know the profile of the online game user, their needs, behaviors, motivations, and how they interact with the offered gaming products. Something that apparently could be difficult due to the current regulations on data protection, but by setting aside demographic information such as educational level or income range; it allows us to firsthand know who is and how the player behaves in relation to the product or service they consume.

Knowing this profile or average player, it is more affordable to launch marketing messages, but also to protect and watch over their interests. Therefore, beyond the curiosity that the report's reader may have, this document is a valuable tool to improve the understanding of the market and optimize communication with customers.

2) It is observed that we are dealing with a transparent market

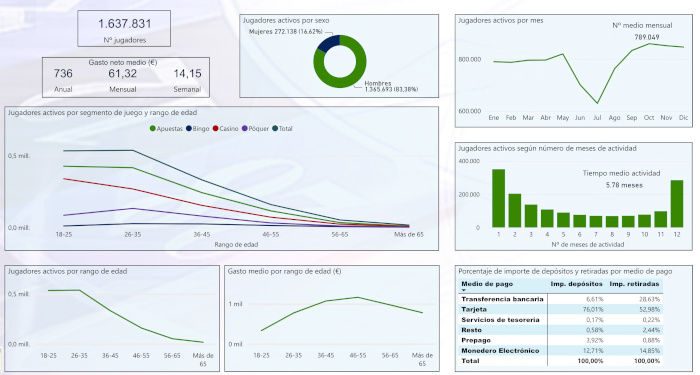

The average number of active monthly players in Spain in 2023 was 789,049, an increase of 7.96% compared to the previous year. But the significant contributions in terms of data would precisely be the total number of players (1,637,837), of which 83.38% are men and 16.62% are women. The youngest age group (18-35) is the most active but spends the least. Sports betting is the preferred product for most of them, closely followed by casino games.

The average activity time for players is less than six months (5.78 months) and exceeding 76%, the card is the payment method used for the vast majority of deposits with operators.

With many more additional data, the report symbolizes the transparency that characterizes the private sector, which, as also happens in the field of land-based gaming, is exhaustively scrutinized.

In this case, for the preparation of this report, data from the SCI (Internal Control System) of online gaming operators authorized in Spain within the framework of the game activity monitoring system was used.

Therefore, it would be interesting to see if public bodies made similar reports for SELAE and ONCE games. In fact, in the methodological section of the report, it explains that data related to mutual bets from the Sociedad Estatal Loterías y Apuestas del Estado, S.A. (SELAE) are excluded "because they are mainly marketed in a face-to-face manner."

3) Without problems of intensive gaming

In light of the data, it is once again confirmed that in 2023 the majority of players have very moderate patterns of deposits and activity, especially when compared to figures such as the average expenditure on lottery and ONCE games.

The report from the Gaming Directorate shows that Spanish online players spend an average of 14 euros weekly, which amounts to 61.32 euros monthly and reaches 736 euros annually.

When analyzing the average expenditure by age, it is highlighted that older players invest significantly more in online entertainment than younger ones. Specifically, the 46 to 55 age group spends the most on online games, with an average annual outlay of 1,165 euros, well above the average of 763 euros annually. The second-highest spending group is those aged 36-45, and the third is 56 to 65 years old, with expenditures close to 1,000 euros. Whereas the 18 to 25 age group, despite playing more, spend much less.

Similar conclusions are reached when reviewing the sections on the level of activity (average participation, average time of activity, new players) or the distribution of expenditure (players with losses and gains and expenditure ranges).

4) Juice segments with potential for new products

In the analysis of the games and the definition of the following segments, an apparent variety of products available to Spanish operators can be observed:

- Counterparty Sports Betting

- Mutual Sports Betting

- Counterparty Horse Racing Betting

- Mutual Horse Racing Betting

- Other Counterparty Betting

- Cross Sports Betting

- Cross Horse Racing Betting

- Other Cross Betting

- Cash Poker

- Tournament Poker

- Black Jack

- Slot Machines

- Roulette

- Baccarat

- Complementary Games

- Bingo

But the reality is that trends in the sector continue to seek the transition to more interactive and personalized multiplayer experiences.

For over a decade, there has been a stronger orientation towards experiences that reflect more real gameplay, with live dealer casino games. This trend has radically transformed the perception of virtual casinos, offering more interactive environments for those who enjoy the thrill of physical casinos but prefer the comfort of playing from home.

In this field, in addition to expanding the range of games beyond roulette and its different variants, there is a focus on more card games and on integrating virtual reality and augmented reality as new ways to further enrich the live casino experience. Although these technologies are still in development, they have enormous potential to create more attractive and realistic gaming experiences.

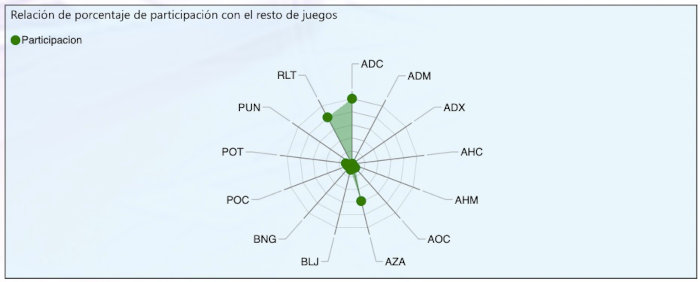

Seeing in the report how in 2016 just 28% of sports bettors (counterparty) played roulette; and how it currently approaches 80%, it would be logical to think that the recreational and fun component understood in this percentage of players who participate in other games; could serve to expand the list of regulated casino games.

Thus, given the success in other regulated gaming markets of live dealer games in poker variants where the player goes against the dealer's hands (Casino Hold’em, Caribbean Hold’em, or Russian Poker) and the increasingly popular shows produced by studios like Evolution, Playtech, or Microgaming (Game Show Games Crazy Time, Monopoly Live by Evolution Gaming, or Playtech's Fun wheel spins), we could expect a greater variety of products in the future that would support this trend of a higher percentage of participation in different games, in a context of contained spending.

It is observed that although bettors have played roulette, the levels of deposits and activity in the casino vertical have not been as significant, confirming that the online casino player seeks entertainment.

5) On the restriction of advertising

Contrary to what was intended, advertising restrictions do not seem to have decreased activity in certain games. For example, casino games and slot machines have experienced an increase in activity, despite the advertising limitations established that have prevented the promotion of many operators who have recently entered the regulated market.

Moreover, according to historical data, in 2016, only 6% of players had accounts with four or more operators, and nearly 70% were limited to having an account with just one. Currently, this trend has moderated, and 55% of players now (2023) have an account with a single operator.

It is more than just commercial communications and advertising; specific games like poker or bingo (with a decline in traffic and player preferences) suggest changes in player preferences.

According to the JDigital report, "The Digital Player in Spain", there is a possibility that illegal operators are growing in popularity, and this goes unnoticed in documents like the profile of the online player analyzed. Evidence such as the increase in poker activity could be demonstrating that perhaps the problem is not knowing the profile of the average player, but what percentage of players go to unregulated operators. This JDigital publication showed that 48.2% of Spanish players cannot distinguish between a legal and an illegal operator; or that 17.2% of users claim to play with unlicensed operators; or even that 35.8% of citizens state they play indiscriminately on legal platforms and on unlicensed websites.

As we warned at the beginning of this INFOPLAY SPECIAL, instead of making a basic summary with the most relevant data from this ONLINE PLAYER PROFILE 2023 published by the DGOJ, we have included many of them in the 5 sections that, as conclusions, we hope have helped the reader to understand the relevance of this presentation, which has been available

HERE since yesterday.

18+ | Juegoseguro.es – Jugarbien.es