Explore our comprehensive analysis of the online gambling market in Italy for the first half of 2023. This article provides detailed insights into the market shares of leading operators, revealing the competitive landscape and trends in one of Europe's most dynamic online gaming markets in the 3 main verticals: sport betting, poker and casino.

In the industry of Betting, transparency is essential. In Italy, the Agenzia delle Dogane e dei Monopoli, the country's gaming regulator, provides public data on the amounts bet by Italian citizens on regulated gaming operators. This data, accessible through various means, offers a clear view of the betting market in Italy, making it easy to calculate the market share of each operator. Unlike other countries like Spain, the transparency of this data facilitates a detailed analysis of the different gaming verticals.

Something that is shown by offering two key and differentiated variables: "Raccolta" (which refers to the total amount of money that has been bet. That is, it is the sum of all bets made by players in a certain period of time) and "Spesa" (literally "expense" which would refer to the total amount of money that players have lost in their bets: the difference between the total amount bet ("raccolta") and the winnings obtained).

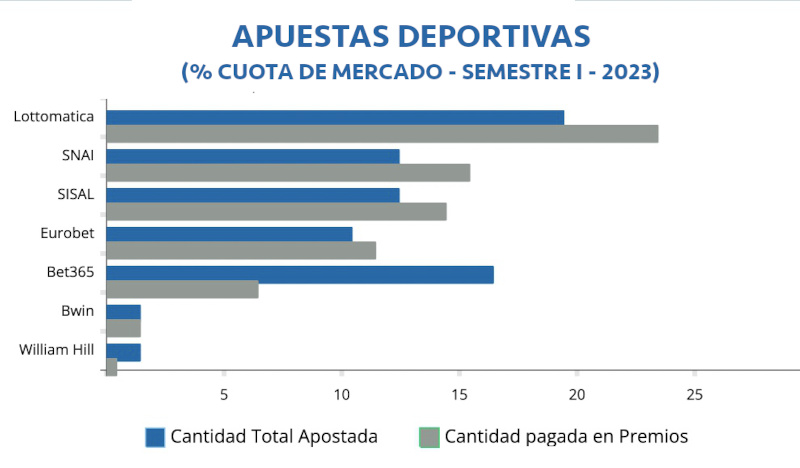

SPORTS BETTING, the main driver of the sector in Italy

In the SPORTS BETTING vertical, three operators clearly lead this segment of the game: Lottomatica, Snaitech, and Sisal. These operators have managed to stand out in a competitive market, demonstrating their ability to attract and retain Italian sports bettors in the first half of 2023 marked by the good performance of Italian football teams in international competitions such as the Champions League, the Europa League.

The market shows an increase of 23.4% compared to the same period of the previous year.

* It should be noted that these tables are self-made and while the TOP-3 operators do appear in the positions they occupy in the market, the other operators shown may occupy much lower positions. They are shown in the table as a way to compare market shares of international operators that we know.

In this expanding market, three companies clearly stand out in terms of betting volume and registrations: Lottomatica, Snaitech, and Sisal. Lottomatica leads the market with a share of 19.8%, closely followed by Snaitech (also known as SNAI) with 12.91% and Sisal with 12.98%. Eurobet also has a significant presence, with a market share of 10.31%.

In fifth place, but no less important, is Bet365, an internationally renowned sports betting operator, which has managed to capture 16.76% of the betting volume, in terms of results it stays with 6% of the difference between the volume of money bet and possible winnings.

Despite their global success, other international operators such as Bwin, William Hill, 888, and Betfair have not been able to replicate their success in Italy. Bwin does not reach a 2% market share, William Hill barely exceeds 1%, and both 888 and Betfair do not reach that 1% market share.

In total, it is estimated that there are about fifty active operators in the Italian sports betting market. Despite the dominance of a few leading operators, competition remains fierce, with each operator seeking its own niche in this growing market.

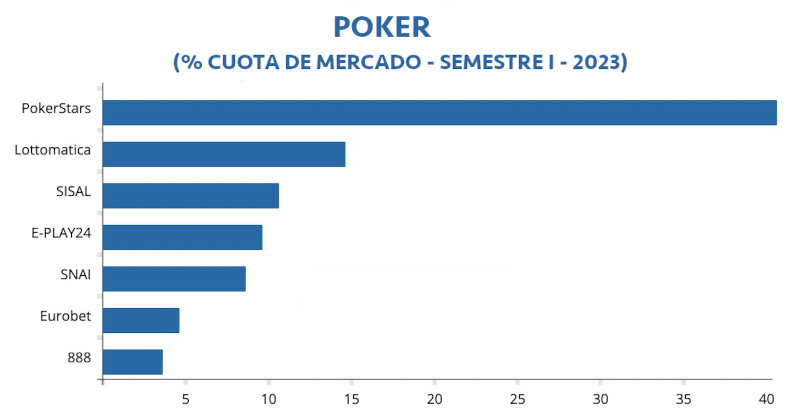

POKER remains steady and PokerStars leads without rival

In the POKER vertical, PokerStars dominates the market, maintaining a solid leadership position. In contrast, the company 888, despite being a recognized name internationally, is in a rather delayed seventh position, demonstrating the competitiveness and uniqueness of the Italian poker market.

It is not a surprise that in this first half of 2023 PokerStars is the undisputed leader of the market. The absence of the French operator Winamax means that the red spade room has no problems dominating the market share in Italy. However, this privileged position does not give the operator much capacity for improvement in the casino and sports betting verticals.

* It should be noted that these tables are self-made and while the TOP-3 operators do appear in the positions they occupy in the market, the other operators shown may occupy much lower positions. They are shown in the table as a way to compare market shares of international operators that we know.

In fact, this spring PokerStars has lost traffic both in poker and business volume in sports betting and casino games.

In any case, in both cash and tournament modes, PokerStars maintains 40% of the poker player traffic in Italy.

The network formed by the brands Lottomatica-Goldbet and Betflag occupies the second place with 15% while SISAL stays with an average of 11% between the segments of tournaments and cash games.

Operators much better positioned in markets like Spain or the UK like 888Poker maintain a discreet 3% while powerful sports betting operators like Bet365 barely exceed 1% market share.

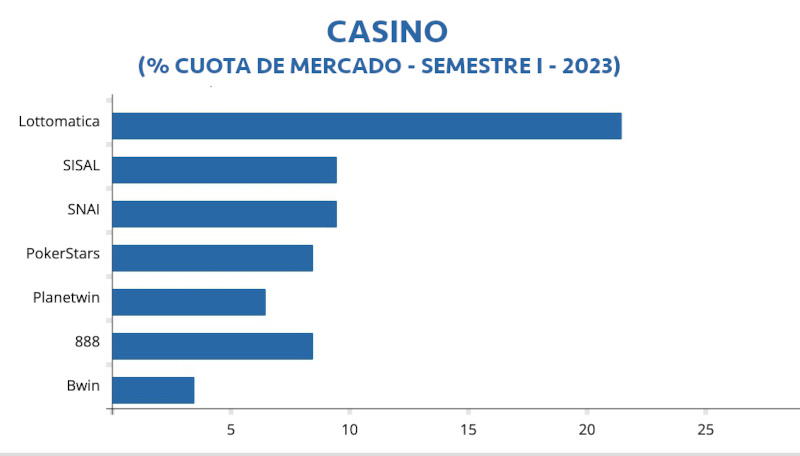

Growth continues in CASINO games

The growth of the online casino market in Italy does not stop. Even in the month of June, spending grew by almost 15%, reaching 175.7 million euros. This means that the advertising ban, activated years ago by the Dignity Decree, has not managed to reduce the use that Italian players make of this gaming product at all.

*It should be noted that these tables are self-made and while the TOP-3 operators do appear in the positions they occupy in the market, the other operators shown may occupy much lower positions. They are shown in the table as a way to compare market shares of international operators that we know.

In this vertical, the leaders in sports betting make themselves noticed and Lottomatica, Goldbet and Betflag make up the TOP-3. These operators have managed to stand out in a segment of the game that is known for its high competition. Meanwhile, other internationally relevant operators are quite delayed, reflecting the peculiarities of the casino market in Italy.

So while the brands of the operator formed by Lottomatica, Goldebt and Betflag lead the market with a market share of 23%, in second place we find Sisal, with a market share of 8.72%, while in third place is Snai with 8.32%.

Pokerstars is positioned in fourth place, with a market share that is reduced to 7% (it had ended the year at 10%). In fifth position we find Planetwin365, with a share of 6%, while in sixth place is 888, exceeding that 6%. The other brand of the 888 group, William Hill continues to recover from some years to forget and already exceeds 1%, staying in the TOP-10 but without surpassing traditional competitors like Bwin.

In conclusion, the gaming market in Italy is characterized by its transparency and the presence of firm leaders in the three gaming verticals. Despite the competition, these operators have managed to maintain their position in this first half of 2023, while many other operators share the remaining market shares. This landscape, although competitive, shows that there are opportunities for those operators who are willing to understand and adapt to the peculiarities of the Italian market.

18+ | Juegoseguro.es – Jugarbien.es