William Hill PLC one of the world’s leading betting and gaming companies, provides a trading update for the unaudited 13 week period to 29 September 2020 (the ‘Third Quarter’).

Highlights

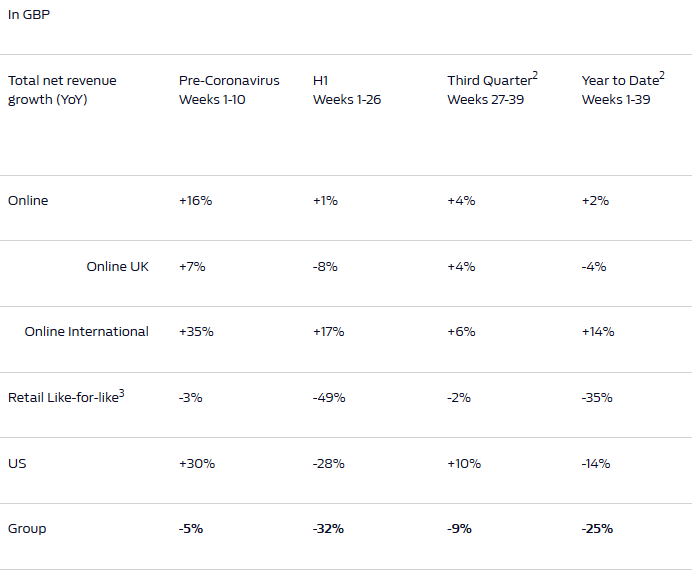

- Robust Group-wide performance as the return of live sport accelerated and Retail estate reopened

- Continued good performance in International Online with gaming growing double digits, partially offset by unfavourable sports results

- Encouraging UK Online progress, rolling out increasingly competitive product with greater velocity

- Rapid recovery in UK Retail as footfall returned towards pre-COVID levels

- Strong US Mobile growth and a good recovery in US In-Person retail experience as live sport resumed and William Hill opened for business in four new states4

Ulrik Bengtsson, Chief Executive Officer, commented “We are very pleased with the trading performance of the Group, which has been borne out of the commitment, resilience and hard work of our teams across the business. I could not be prouder of them.

“We have moved the company forward with our relentless focus on our customers, enhancing the competitiveness of our product, and maintaining player safety as one of our highest priorities. We have reinvigorated the leadership team and they, in turn, have empowered their teams to deliver on our plans.”

Operational Summary

Our Third Quarter3 performance was encouraging across all of our divisions, demonstrating a resumption in good growth in both our UK and International online operations, with our UK Retail business trading broadly on par with last year on a like-for-like basis. Our expansion in the US has continued as we returned to growth whilst our agreements with CBS and ESPN expand our digital and media reach in those growth markets.

The live sporting calendar has resumed, delivering a strong complement of fixtures across football, horse racing, tennis and American sports. However, fixture lists remain out of step with prior years and with many events continuing to be held behind closed doors, results have been more unpredictable than normal. As a result, we continue to see volatile gross win margins, and we would expect this situation to continue.

Furthermore, as Governments vary their response to the COVID-19 pandemic, we will continue to mitigate the impact on our business through careful cost control and cash management. Supported by the measures we have taken to enhance our strategic and financial flexibility, we are well placed to navigate the principle risks of the global economic outlook and the increasing burden of gaming regulation.

Online

International Online gaming delivered an updated version of our Mr Green live casino, offering an improved player experience across multiple regions, including implementation of several industry leading games. We launched new applications to deliver local offers in several core markets, helping to drive double digit gaming net revenue growth during the period.

In UK Online gaming we continued to add new features, making incremental improvements to our new gaming product. In sports betting, our new betslip was introduced before the start of the new English Premier League season. This is the first significant update of our UK architecture in five years and has made placing a bet quicker and more intuitive, while allowing for rapid implementation of new features.

Customer protection has remained a high priority throughout the Coronavirus pandemic. The enhanced safety measures we introduced during lockdown have been maintained, with gaming net revenue growth reflecting the implementation of strong guard rails throughout the period. In addition, we have added a 1-hour session reminder to all our gaming customers. We have continued to engage proactively with the Government and other interested parties in anticipation of the Gambling Review which we now expect to be launched in the coming weeks.

In Germany, a transitional regime has been agreed by 16 German federal states (Lander) in relation to gaming, which applied as of 15 October 2020, ahead of implementation of an Interstate Treaty in 2021. Several measures have been implemented, including deposit limits of EUR1,000 per month and the removal of live casino. The sports betting licencing process has also restarted and the Group is actively pursuing applications for those licences. With a multi-brand approach and returning advertising capabilities, we anticipate the EBITDA contribution from Germany for 2021, will be reduced by c.£10m after mitigations.

Retail

Following a phased reopening of the estate, UK Retail, where we operated 1,414 shops during the period, delivered a good performance. Our agile response to the fluid trading environment and previous actions to right size the estate, have proved timely and appropriate. Our popular retail format saw footfall return towards pre-COVID levels, as customers migrated within the smaller estate, and the extensive measures we took to make them feel safe benefitted both footfall and staking levels. The strategic alignment of our UK Online and Retail operations commenced, as we deliver on the next logical step in the development of the UK business to offer our customers a seamless experience.

In light of the good performance and our decisive actions to preserve cash, protect liquidity and strengthen the balance sheet, we have committed to repay the Coronavirus Job Retention Scheme monies, amounting to £24.5m.

During Q3, several regions experienced local lockdowns, while our estate in Scotland operated under restricted conditions until the use of gaming machines was re-instated on 24 August. We will continue to implement central government and local authority guidelines, maintaining our focus on the welfare of our customers and colleagues, and ensuring our staff continue to receive their full salary.

With respect to further local lockdowns we estimate that, on average, the closure of 100 shops for four weeks would reduce EBITDA by c.£2m, excluding the benefit from any job support schemes for which the Group may be eligible. At the current time, c.10% of our retail estate is located in regions where the local COVID-19 alert level is classified as ‘very high’ as defined by the latest Government disclosure.

US

Sports content and the In-Person retail experience were slower to resume in the US, with MLB, NBA and NHL only recommencing their 2020 seasons late in July. We are now live in 14 states4, having opened in Colorado, Illinois, Michigan and Washington D.C. during Q3 and Pennsylvania during October. Wagering growth was strong, taking 72% of handle through mobile channels.

We were pleased to extend our media and digital presence to include ESPN through a multi-year co-exclusive agreement signed by our partner, Caesars Entertainment. In combination with the exclusive deal signed with CBS in February, William Hill US now has access to two of the top sports media brands in North America.

We also completed the acquisition of Cantor sports books and commenced the integration of Caesar’s In-Person retail sports books. Following the full integration of the Caesars’ sports books, we will operate more than 170 venues across 15 states, of which the majority will have a mobile William Hill presence.

Operating Performance1: 13 week period to 29 September 20202

In GBP

VAT recovery and Revolving Credit Facility

During the first half of 2020, HMRC confirmed it would not appeal the refund of VAT incorrectly applied to certain gaming machines. We have received elements pertaining to our claim and expect to receive the balance of the refund imminently. During Q3, we repaid the revolving credit facility and, as a consequence, we remain on target to achieve net debt/EBITDA of 1-2x by the year end.

Recommended cash acquisition

On 30 September 2020, the boards of William Hill, Caesars and Caesars UK Bidco announced that they had reached agreement on the terms of a recommended cash offer by Caesars UK Bidco for William Hill, pursuant to which William Hill shareholders will be entitled to receive 272 pence in cash for each William Hill share. The offer is conditional on, amongst other things, shareholder approval and the obtaining of certain regulatory consents.

The recommended cash offer is proposed to be effected by way of a scheme of arrangement under Part 26 of the Companies Act 2006. Further details of that scheme of arrangement will be released by the Group in due course.

Download full trading update in PDF format

18+ | Juegoseguro.es – Jugarbien.es

.png)