The National Gaming Authority (L'Autorité Nationale des Jeux, ANJ) has published a report summarizing French gaming activity during 2021, which confirms the dynamic growth of the gaming market with a turnover of 10.7 billion euros (+ 7% compared to 2020).

The following table includes the main data that we will explain later:

ANJ explains that although the pre-pandemic level has almost recovered thanks to the dynamism of lottery activities (+16%) and online sports betting (+44%), a strong recession prevails in the casino sector.

About the activity of the monopoly operators (FDJ and PMU), the report indicates that turnover is increasing, but this renewed dynamism hides highly contrasting developments according to the gaming segments.

With gross gaming revenues (GGR) reaching 8,500 million euros, the gaming activity offered by operators with exclusive rights (La Française des Jeux for lottery and sports betting at points of sale, Pari Mutuel Urbain for horse betting at points of sale sales) is the first pillar of the French market (70% of GGR).

This activity shows a significant level of global growth compared to last year (+around 12%), thanks to the normalization of its environment: reopening of almost all points of sale since June, sports and horse racing calendars that return to its normal format.

The growth is mainly driven by Française des Jeux, which recorded a GGR of more than 6 billion euros in 2021 thanks to the dynamism of the lottery offer: just over 5 billion euros in 20211, +16 % compared to 2020.

After a difficult 2020 financial year, marked by the drop in gross gaming and betting revenue, monopolistic horse racing activity is growing again, with a GGR of 1,554 million euros (+14% compared to 2020). In 2021, PMU's point of sale turnover remains below its pre-health crisis level (1.8 billion euros in 2019).

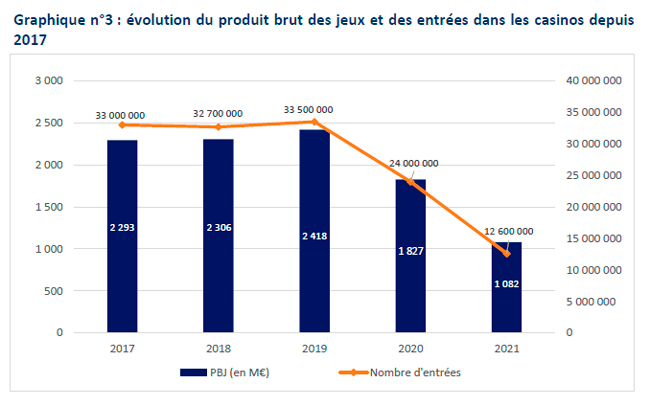

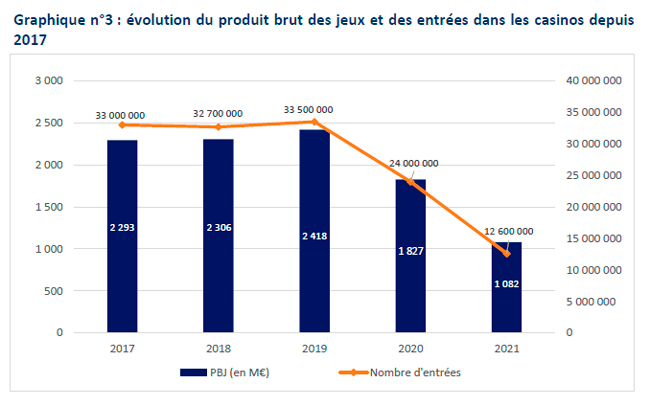

This dynamic contrasts sharply with the situation of the casinos, marked by more than six months of closure, which registered a GGR of 1,080 million euros as of October 31, 2021, that is, a drop of 41% compared to its previous level, as you can see in the next image.

Regarding online gaming (sports betting, horse betting and poker) continued its strong growth in 2021 (+24% compared to 2020) and registered a record by exceeding the threshold of 2,000 million euros (2,200 million euros) of PBJs.

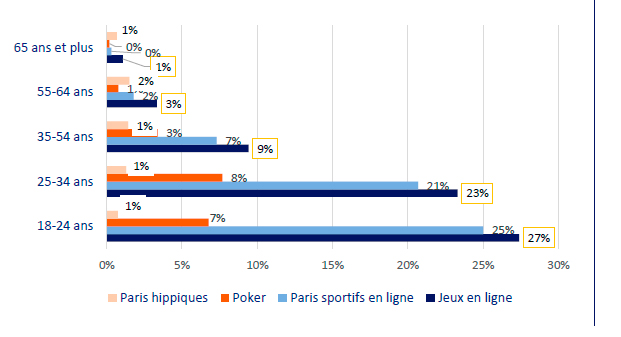

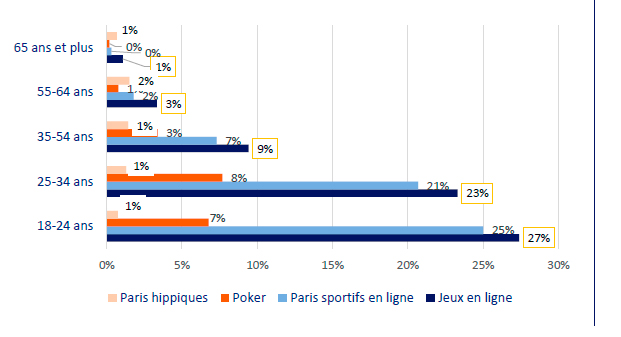

As explained by the ANJ, this turnover from the online market now represents around 20% of the total turnover of the sector (compared to 17% in 2020). This segment of the offer contributes to rejuvenating the group of gamers and is asserting itself as an increasingly strong driver of the gaming market in France, in a context of accelerating digitization of gaming practices.

The number of active player accounts (CJA) is also growing with more than 5.4 million active accounts across the various licensed operator sites and apps (+11% compared to 2020).

On the other hand, online sports betting emerges as a powerful engine for the development of the market with spectacular growth (+44%), a record level of bets (7,890 million euros) and a gross gaming product that exceeded one billion euros to reach 1,400 million euros.

This exceptional increase over 2020 benefited from an attractive sports calendar, culminating in the Euro 2020 football tournament generating €445 million in bets. Football continues to be the sports discipline that generates the most bets.

More specifically, sports betting represents 82% of active player accounts (AGA) in the online gaming sector. The number of CJAs in sports betting increased by 16% in 2021 compared to 2020, to 4.5 million. Finally, turnover per active player account grew by around 25% to reach 303 euros in 2021, a clear sign that the market continues to expand.

On online horse racing, the report reveals growth momentum despite a slowdown at the end of the year. The total bet on the horse racing offer amounted to 1,583 million euros, 7% more than in 2020 and 44% more than in 2019. The French racing offer represents 80% of the bets on the activity in 2021.

Contrary to what happened with betting, the number of horse racing bettors fell slightly in 2021 to 624,000 players, but with a more intensive game, as evidenced by the turnover per active player account of 601 euros, 7% more than in 2020.

Poker is the second activity in the online market in terms of billing, contributing its results with 20% of the total billing of the sector. Fueled by unprecedented enthusiasm during the health crisis, the online poker market saw exceptional growth in activity in 2020.

In 2021, it registered a GGR drop of 4% compared to 2020 (429 million euros). However, it is still much higher than the 2019 data (+58%).

The number of participants in online poker games (approximately 1.7 million CJA) fell by 10% compared to 2020. However, it is still much higher than the years prior to the year 2020. Individual spending average has increased by +7%, or €259 per CJA, which is its highest level in recent years

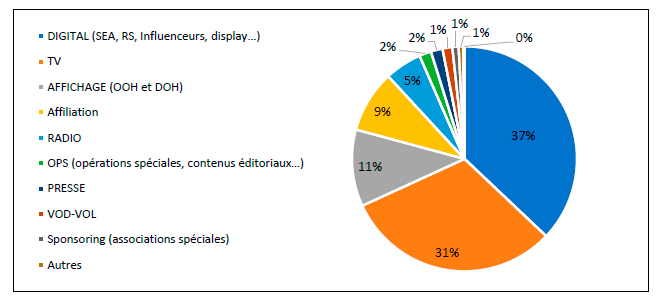

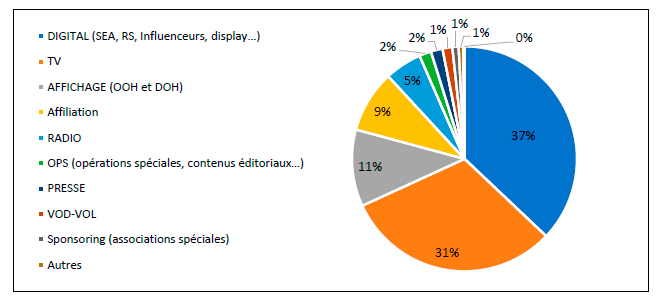

To conclude, it is worth mentioning the considerable increase in investment in advertising, especially during Euro 2020, which took place in June and July 2021. Advertising investment went from 161 to 191 million euros between 2020 and 2021 (+19% ).

Advertising investments by gaming operators reached a record amount of €237 million in 2021, including €49 million during the Euro 2020 period alone.

However, the poor performance of the French soccer team during this competition, eliminated in the 1/8 final at the end of June, led the operators to incur less advertising expenses than expected.

FULL REPORT

18+ | Juegoseguro.es – Jugarbien.es