Although the 2022 Annual Report of William Hill seemingly hasn't garnered much interest in the British financial press, not even in the media specialized in gambling, the reality is that upon scrutinizing the data provided in the so-called "year of recovery" after the pandemic, we can find the answer to one of the most recurring questions following the announcement of William Hill's acquisition under the terms that took place between September 2021 and July 2022.

1 - Introducción y descripción general del Informe Anual 2022

This annual financial report provides a comprehensive overview of the economic situation and performance of William Hill in the year following the pandemic, the 2022 fiscal year, which also marked the beginning of a business plan aimed at optimizing the recently merged entity with 888 Holdings.

In terms of economic data, there was a 0.5% reduction in William Hill's revenues, reaching £1.24 billion. However, this decline in online business revenues was largely offset by a strong resurgence in the retail sector.

The good news came from the revenues generated by the excellent performance of the retail business, particularly in the UK, which increased by 52.7% year-on-year, reaching £514.2 million.

However, there was a 19% decrease in online revenues in the UK and a 23% decrease in international online activity revenues.

But we won't focus solely on the numbers; we will also review qualitative aspects highlighted in the report, especially regarding the existing threats to the company and the future plans integrated within 888 Holdings.

2 - Key data from William Hill's financial year

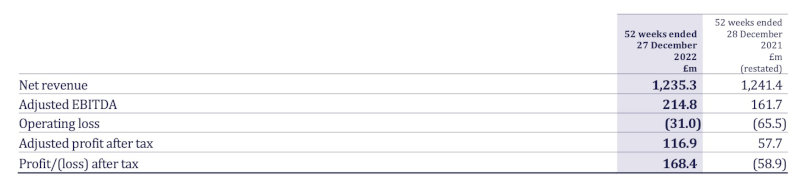

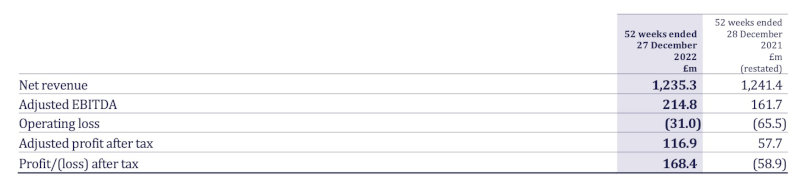

Naturally, within the nearly 80 pages of the document, there is a multitude of accounting data. However, the most important ones are related to the following variables:

- Net revenue: The total amount of income generated by the company after deducting any discounts, returns, or sales taxes.

- Adjusted EBITDA: Reflecting the adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization, which expresses the operational profitability of a company before considering interest, taxes, depreciation, and amortization. It is adjusted to eliminate certain non-recurring or non-operational elements.

- Operating loss: The amount of money a company loses in its regular business operations before considering other non-operational income or expenses.

- Adjusted profit after tax: The net profit a company obtains after adjusting its income and expenses to eliminate non-recurring or non-operational elements.

- Profit after tax: The net profit a company obtains after deducting all applicable taxes from its income.

However, the significant aspect in any case is to divide these figures of William Hill Limited into its three major divisions: UK retail business, UK online business, and online business in regulated markets outside the UK.

a) UK Retail Business

The total net revenues of the UK retail business in the 2022 fiscal year were £514 million, a 53% increase compared to 2021, a year marked by the pandemic. These revenues contributed to a total adjusted EBITDA of £95.7 million.

b) UK Online Business

In the UK online business, historically the strongest segment representing nearly 80% of its results, it reached £590 million. This is a 19% decrease compared to the £628 million in 2021. This contributed an additional £112 million to adjusted EBITDA.

c) International Online Business

Net revenues slightly exceeded £212 million (-23% compared to £276 million in 2021). Regulated markets such as Italy, Spain, etc., contributed only £33 million to EBITDA.

The conclusion is that Net Revenues decreased by 0.5% (from £1.241 billion in 2021 to £1.235 billion in 2022), while adjusted EBITDA increased as operational profitability grew due to the excellent performance of the retail division.

Additionally, the most striking data in 2022 are the evident cost reductions, which will be shared in the section dedicated to the merger with 888.

3- Threats to Consider

In addition to the revenue stagnation and cost containment efforts, the 2022 Report becomes an illustrative document of the realities that should concern both the company and the entire industry.

Among the extensively discussed warnings in the document, there is concern about the rising inflation figures and increasing interest rates in the UK, although applicable to all European countries.

This reality is reflected in a significant increase in costs related to energy, transportation, and services. This was already having a very negative impact not only on the global economy but also on the average spending of citizens dedicated to entertainment.

Furthermore, it is noted that achieving the established objectives in the markets where William Hill is present is challenging due to stricter restrictions on commercial communications. Therefore, regulated markets are being closely monitored by the Company's Management to determine their viability. The emphasis is placed on the potential impact of a rigorous review of the Gambling Act in the UK.

As an internal threat, but one with anticipated significant impact, the uncertainty regarding human resources and talent within the company arising from the merger with 888 and the necessary workforce reduction due to aspects such as job duplication is mentioned. Retaining key employees and continuing to hire skilled and experienced professionals within the sector will be one of the challenges for 2023 and 2024.

4 - On the merger with 888 and Growth Plans

The 2022 Financial Report also outlines the main guidelines on which the merger between the two giants of the industry, William Hill and 888, will materialize. It is crucial not to overlook the gradual decline in William Hill's stock price in recent years, which culminated in months of stability but without any signs of recovery.

The reality was that after the acquisition announcement, the increase in stock price was solely focused on 888 Holdings, with the expectation that the merger would lead to a period of growth in the value of the new company on the stock market. However, as we have already seen since late 2022, the stock price of 888 Holdings, with William Hill already integrated into the company, has been highly variable. There was an evident slump until 2023, when it surpassed 86 pounds and reached over 100 again.

In any case, the importance of economies of scale resulting from the union of the two companies is evident, and the focus is on the clear opportunities that arise in regulated markets, especially in Latin America and Ontario, Canada.

The report also clarifies the experts' anticipated reality regarding a complete technological migration to a single gaming platform for all brands of the new corporation, especially WH, Mr Green, and 888.

However, as we have previously mentioned, the reduction in costs is evident in the data of this 2022 report. While the operating expenses remained relatively unchanged, cuts were made in marketing, allowing for a significant reduction in operating losses. Legal costs, particularly related to corporate movements, also increased significantly.

CONCLUSION

Analyzing the data from this 2022 report, we observe a stagnation in William Hill's ability to generate profits and deliver them to its shareholders. While there is an apparent improvement in the post-COVID reality at first glance, it is also evident that the online division was unable to maintain William Hill's leading position in the market share in the UK and the main regulated European jurisdictions.

Moreover, high operating costs are observed, although detailed country-specific information is not provided. This indicates a total dependency on what happens in the UK, a market where significant regulatory changes were anticipated. Thus, only the merger with 888 could help maintain its competitive position in the market.

Therefore, despite the attention-grabbing nature of 888 acquiring all of William Hill's business in its home market, the UK, as well as the rest of Europe, creating a gaming group with a turnover exceeding 2 billion euros, as it is today, was a necessity. It demonstrates the importance of having a diversified business, both in terms of brands and a balance between physical and online presence.

18+ | Juegoseguro.es – Jugarbien.es